Introduction

The key to growing any business is being able to finance it at a relatively inexpensive cost of funds with maximize leverage. The SBA Guaranteed loan programs (primarily the SBA 504 and SBA 7(a) loans) really fill the gap between lower-leverage conventional loans and having to raise substantial external funds. After all, most businesses fail due to a lack of capital.

Starting a business entails answering a lot of “What-if” questions such as…

- You may have a great idea, or

- Maybe you have already started the business, but you don’t have two years of a track record yet, or

- You don’t have the cashflow to cover the debt, or

- Perhaps you are buying a business that has been running for many years and the financials easily support your loan request BUT you might not have the equity injection or down payment to purchase the business…

These are all reasons the SBA loan programs can be incredible options. For example, in many cases, they can be used to fund up to 90% of total costs. A more extreme but totally possible scenario: On a “rent replacement” loan request, you can get up to 100 percent financing!

Where else can you get that type of financing?

This book is a great starting point for learning about the SBA loan programs, their benefits, and the features these loan programs have to offer.

After you read the book, I am sure you will have some questions. Please feel free to schedule a 100 percent free 30-minute call with me to discuss your unique situation.

History of the Small Business Administration

The Small Business Administration helps Americans start, build, and grow businesses. Through an extensive network of field offices and partnerships, the Small Business Administration assists and protects the interests of small business concerns.

The SBA was established on July 30, 1953, when Republican President Dwight D. Eisenhower signed the Small Business Act. Its mission was and continues to be to “help, counsel, and protect, to the extent practicable, the interests of small business concerns.”

Banks, credit unions, and other lenders that work with the SBA make SBA loans. On a portion of the loan, the SBA provides a government-backed guarantee. SBA loans were enhanced to provide up to a 90% guarantee under the Recovery Act and the Small Business Jobs Act to help small firms gain access to finance after the credit freeze in 2008.

The SBA helps the federal government to award small companies 23 percent of prime federal contracts. Efforts to ensure that some federal contracts reach woman-owned, minority, and service-disabled veteran-owned small businesses, as well as businesses participating in programs like the 8(a) Business Development Program and HUBZone, are among the small business contracting programs. The Small Business Administration (SBA) launched the SBA Franchise Directory in March 2018, with the goal of connecting entrepreneurs with lines of credit and financing to help them grow their enterprises.

Every state in the United States has at least one SBA office. In addition, the organization funds counseling partners such as the 900 Small Business Development Centers (typically housed in schools and universities), 110 Women's Business Centers, and SCORE, a volunteer mentor corps of retired and experienced business professionals with 350 chapters. Over 1 million entrepreneurs and small company owners benefit from these counseling programs each year. In January 2012, President Barack Obama announced that the Small Business Administration will be elevated to the Cabinet, a position it had maintained since the Clinton administration, making the Administrator of the Small Business Administration a cabinet-level position.

What Kind of Business Will You Be Financing?

When it comes to getting financing through the SBA, you need to first consider what kind of business you will be financing. Will it be an existing business, a new business, or what we in the industry call “rent replacement” (which is when you are currently renting but want to buy the building your business resides in)?

The answer above will drive which type of SBA loan you will seek.

For example, if you want to buy an existing business, then you’ll probably want to apply for an SBA 7(a) loan since real estate is not a requirement for an SBA 7(a). Let’s say you want to buy a restaurant. The current business rents the building, and you are not attempting to buy the underlying real estate; you just want to purchase the restaurant business. A 7a loan would be best in this situation.

On the other hand, let’s say you want to start a self-storage facility. That requires the purchase of land and the buildings and other related costs. In this case, an SBA 504 loan would be your best option; however, an SBA 7(a) can also be used for the same situation.

Let’s say you’re buying an established self-storage facility. You’re not only buying the real property (land plus buildings), but also accounts receivable and a significant amount goodwill (defined: the established reputation of a business regarded as a quantifiable asset, e.g., as represented by the excess of the price paid at a takeover for a company over its fair market value). If this is the case, an SBA 7(a) is the only option you can choose since goodwill can be included in a 7(a) loan.

To put it another way, SBA 504 loans are geared specifically for the purchase hard assets like land, construction, and equipment.

To complicate matters a bit more, you can have a situation where you can get an SBA 504 with a companion 7(a) loan. This would work when there are “intangibles” involved in the deal like the aforementioned goodwill (also called ‘blue sky’).

As you can see, it can be a bit complicated. This is why it’s highly recommended that you find an experienced commercial mortgage advisor.

Popular business types that take advantage of the SBA loan program are:

- Retailing Electronics

- Self-storage Facilities

- Franchises

- Restaurants

- Car Washes

- Laundromats

- Gas Stations & Convenience Stores

- Health Services & Physicians/Doctors Office/ Dentistry

- Assisted Living Facilities

- Strategy/General Consulting

- Software Development

- Hotels, Motels, Lodging

- And many others

Obviously, nearly any business can be eligible for an SBA loan.

Advantages of “Going Green”

The SBA offers another loan program that is an extension of the SBA 504 loan called the “504 Green Loan.”

Small businesses who want to expand their operations and “go green” by purchasing commercial real estate can benefit the environment and their finances by taking advantage of the SBA's 504 Green Loan Program by becoming energy efficient with their building. Discuss the options available with your trusted advisor.

With this program, you can bypass some of the traditional 7(a) and 504 limitations, such as only being able to have $5 million in SBA loan proceeds. An SBA 504 Green loan gives you up to $5.5 million on a second mortgage and cannot exceed $16.5 million in the aggregate for a total of three projects.

Which SBA loan program should you use?

SBA 7(a)

The SBA's most popular loan program for small business owners is the 7(a) loan, and many people who would not normally qualify for a traditional small business loan find that they do through the SBA 7(a) program. While many people believe that the SBA 7(a) loan is exclusively for individuals who want to start a new business, it is also an ideal financing instrument for those who wish to expand an existing business, refinance high-interest debt, buy a building, or finance a construction project.

SBA 504

The SBA 504 loan program, unlike the 7(a) loan program, is more specific in terms of what you can utilize the money for. The SBA created this loan to help and encourage small business growth, and the money must be used for fixed assets like commercial real estate and equipment. The pricing on 504 loans is typically more advantageous than the pricing on the SBA 7(a) loans.

The SBA 504 loan allows business owners to fund construction expenditures, closing costs, and soft charges, such as architectural fees, engineering fees, surveys, title insurance, and more, inside the loan if they're buying an existing building, expanding, or creating a new one. Equipment, furnishings, fittings, signage, landscaping, and parking lots are all possible additions. Borrowers can keep more of their working capital for other purposes as a result of this. Cash-out refinance programs are also available.

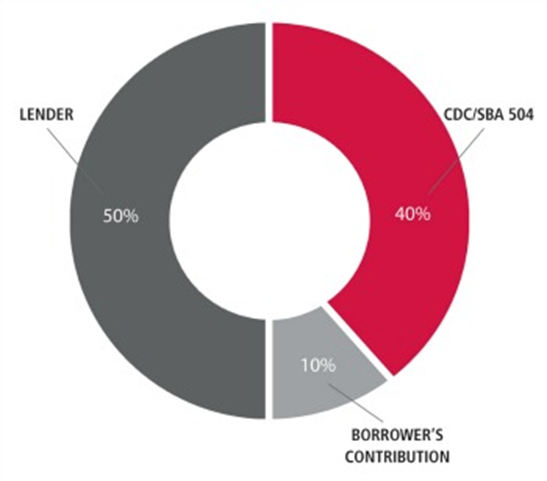

When you get an SBA 504 loan, you are really getting two loans: One from a third party and one from the CDC/SBA. CDCs are non-profit corporations certified and regulated by the Small Business Administration to package, process, close, and service SBA 504 loans.

A typical SBA 504 loan structure is as follows:

- 50% lenders note

- 40% CDC/SBA 504 note

- 10% borrower injection

NOTE: The lender makes a loan for both the lender’s note and CDC/SBA 504 note. Then the CDC takes out the second note from the lender. This is known as the debenture.

If you're not sure which program is right for your company, keep in mind that you don't have to do it alone.

To discuss your alternatives, contact an experienced commercial mortgage advisor.

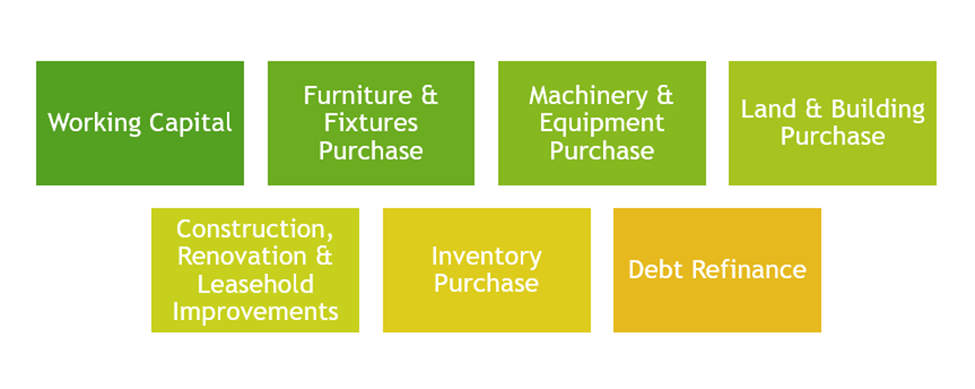

Eligible Uses of Funds

Ineligible Use of Funds

- A loan to an applicant for the benefit on an ineligible affiliated business

- Floorplan financing

- Investments on real or personal property acquired and held primarily for sale or lease

- Payment of Delinquent Taxes

- To finance the relocation of the Applicant business out of a community, if there will be a net reduction of one-third of its jobs or a substantial increase in unemployment in any area of the country

Collateral requirements for SBA loans

Typically, SBA 504 loans do not require collateral beyond the existing collateral of the project, but it does vary based upon your lender.

However, SBA 7(a) loans usually require additional collateral. Here’s what the SBA says about a 7(a) loan:

Lenders are not required to take collateral for loans up to $25,000. For loans in excess of $350,000, the SBA requires that the lender collateralize the loan to the maximum extent possible up to the loan amount. If business fixed assets do not “fully secure” the loan the lender may include trading assets (using 10% of current book value for the calculation) and must take available equity in the personal real estate (residential and investment) of the principals as collateral.

Source: https://www.sba.gov/partners/lenders/7a-loan-program/types-7a-loans#section-header-0

How do you qualify for an SBA loan?

While the vast majority of businesses are eligible for financial assistance from the SBA, some are not.

Eligible businesses must:

- Operate for profit

- Be engaged in, or propose to do business in, the U.S. or its territories

- Have reasonable owner equity to invest

- Demonstrate the Need of Desired Credit (*Credit not available elsewhere)

- Use alternative financial resources, including personal assets, before seeking financial assistance

- Real Estate must be at least 51% Owner Occupied (based on rental square footage determined by Appraiser)

For new construction, however,

- The property must be at least 60 percent owner occupied,

- May lease long term no more than 20% of rentable space,

- Plan to occupy within 3 years some of the remaining space and occupy within 10 years all rentable property not leased long term

Legalese: The SBA defines “owner-occupied” as a minimum of 51% owner occupancy by square footage. SBA loans do provide for non-owner use as long as the owner utilizes at least 51% of the usable space.

* As part of the credit elsewhere test, SBA requires the personal resources of any owner of 20 percent or more of the small business applicant be reviewed. The rule also applies to each person when the combined ownership of the spouses and dependent children is 20 percent or more.

Source: https://www.sba.gov/partners/lenders/7a-loan-program/terms-conditions-eligibility

What can disqualify you from getting an SBA loan?

The information below was taken directly from the SBA website. Source: https://www.sba.gov/partners/lenders/7a-loan-program/terms-conditions-eligibility#section-header-19

Ineligible businesses include those engaged in illegal activities, loan packaging, speculation, multi-sales distribution, gambling, investment or lending, or where the owner is on parole.

Specific types of businesses not eligible include:

- Real estate investment firms, when the real property will be held for investment purposes as opposed to loans to otherwise eligible small business concerns for the purpose of occupying the real estate being acquired.

- Firms involved in speculative activities that develop profits from fluctuations in price rather than through the normal course of trade, such as wildcatting for oil and dealing in commodities futures, when not part of the regular activities of the business.

- Dealers of rare coins and stamps are not eligible.

- Firms involved in lending activities, such as banks, finance companies, factors, leasing companies, insurance companies (not agents), and any other firm whose stock in trade is money.

- Pyramid sales plans, where a participant's primary incentive is based on the sales made by an ever-increasing number of participants. Such products as cosmetics, household goods, and other soft goods lend themselves to this type of business.

- Firms involved in illegal activities that are against the law in the jurisdiction where the business is located. Included in these activities are the production, servicing, or distribution of otherwise legal products that are to be used in connection with an illegal activity, such as selling drug paraphernalia or operating a motel that permits illegal prostitution.

- Gambling activities, including any business whose principal activity is gambling. While this precludes loans to racetracks, casinos, and similar enterprises, the rule does not restrict loans to otherwise eligible businesses, which obtain less than one-third of their annual gross income from either the sale of official state lottery tickets under a state license, or legal gambling activities licensed and supervised by a state authority.

- Charitable, religious, or other non-profit or eleemosynary institutions, government-owned corporations, consumer and marketing cooperatives, and churches and organizations promoting religious objectives are not eligible.

The Loan Application Process

To begin the SBA loan application process, you will need to complete the SBA’s Form 1919 (7a). All associates of your business will need to fill out this form, as well as all owners of 20 percent or more of the business. Additionally, all officers and directors, managing members, and any person hired to manage the daily operations will have to complete this form.

Any person guaranteeing the loan will need to fill out this form, as well.

Other documents you will need:

- Personal Financial Statement – SBA Form 413

- Business Financial Statement

- Business Debt Schedule

- Interim Balance Sheet

- Interim Profit & Loss Statements

- Projected Financial Statements that include month to month cash flow projections, for at least a two-year period with assumptions (preferably three years)

- Income Tax Returns:

- three years signed personal income taxes including all statements and schedules.

- three years signed business income taxes including all statements and schedules.

- Resumes Include personal resumes for each principal.

- Business Overview and History Provide a history of the business and its challenges. Include an explanation of why the SBA loan is needed and how it will help the business.

- Additional Documents (If Purchasing an Existing Business) The following information may be required for purchasing an existing business:

- Current balance sheet and P&L statement of business to be purchased

- Previous three years’ federal income tax returns of the business to be purchased

- Asking price with schedule of inventory, machinery and equipment, furniture and fixtures

- Franchise or licensing agreements, if applicable

Additional documentation may be required based upon the specific loan request.

Expect anywhere from 7 to 14 business days for an approval from the bank. Keep in mind, if this is for an SBA 504, the loan package will be sent to the SBA for the secondary underwriting approvals.

Tips to Get Your Loan Approved

- Detailed business plan with projections

- Have all your financials organized and ready to upload

- If you own additional businesses, remember you will need 3 years of tax returns in addition to an interim financial statement if ownership is 20 percent or greater and request the Franchise Disclosure Document (FDD)

- If you’re buying a franchise, make sure it’s on the SBA-approved directory

- If you’re buying an existing business, you will need three years of the seller’s business tax returns and a year-to-date interim statement

- Banks and non-bank SBA lenders have different loan appetites. This is why it’s important to work with a commercial mortgage advisor to help you find the best fit for your particular loan scenario

- Most banks make more money on originating SBA 7(a) loans versus the 504 loans; therefore, often times, banks send you down the SBA 7(a) loan path, even if it’s not the best fit

Common Scenarios for use of SBA Funding

- Start ups

- Business Acquisitions

- Business Expansions

- Partner Buyout

- Real Estate Purchase (or Refinance)

- Business Debt Refinance

Maturity Maximums

- Working Capital or Inventory loan terms should be appropriate to borrower’s ability to repay but no more than 10 years

- Machinery – 10 year or its useful life up to 25 years (need independent appraisal to support longer life)

- Real Estate up to 25 years

- If construction/ renovations and purchase of real estate is greater than 51% of the loan, then the loan will be 25 years

- If not, then the term will be blended accordingly

- Just about everything else – 10 years

General Notes on Interest Rates

For SBA 7(a) loans, interest rates are tied to the prime rate plus a margin, typically between 2 and 2.5 percent. For 504 loans, you have two loans – the bank or senior loan plus the CDC/SBA second loan. The CDC loan is either 10, 20, or 25 year amortization and is a fixed amortization for the term on the loan. For the senior loan, you get a 5 or 10 year fixed amortized over 25 to 30 years. All lenders have different programs.

Prepayment Penalties

In general, an SBA 7(a) loan has a pre-payment penalty of 3 years; an SBA 504 comes with a declining pre-payment penalty (declines each year).

Equity Injection Requirements

The SBA requires what they call an “equity injection.” Typically, the SBA can lend a total of 90 percent of cost on a 7(a) and 504. A potential borrower can use some of their own funds or a combination of the below:

- Cash that is borrowed through a personal loan, however:

- Must prove repayment from source other than cash flow of business

- Salary paid to owner does not qualify

- Example: Home Equity Line of Credit will work if ability to pay HELCO is based off outside sources of income not from our borrowing entity.

- Gifted Funds from friends or family – gift letter must be provided with notary prior to closing

- Investor Funds, however:

- If one inventory contributes majority/ all required equity injection and holds ownership they might be subject to personally guaranty the SBA loan

- Assets Other than Cash – Fixed Assets owned by applicant that will be injected into the business.

- Requires appraisal or valuation by independent 3rd party

- Example: Land owned prior to applying for the SBA loan

Seller financing

Seller notes issued by the Small Business Administration (SBA) must be placed on full standby for the term of the loan unless the seller is carrying back more than 5 percent of the equity injection portion.

Previous SBA 7(a) borrowers were required to put down 20% to 25% of the purchase price of a business; however, under the revised standards, the SBA can fund up to 90% of a business acquisition, with a seller note covering the remaining 5% of the purchase price. Borrowers are still required to contribute a minimum of 5 percent equity at closing. Seller notes secured by SBA 7(a) loans are normally required to be placed on full standby for the length of the loan. This means that if an SBA 7(a) borrower takes out a 10-year, $500,000 loan to purchase a firm and receives a seller note for $25,000, the borrower will not be required to repay that portion of the loan until the 10-year period has expired. However, the remaining $475,000 in cash will be paid to the borrower upon completion of the transaction.

More money can be carried back by the seller, but at least 5% of the total must be held in reserve.

SBA 504 with a companion 7(a)

A business owner may choose to explore an SBA 504 loan for a variety of reasons. SBA 504 interest rates are lower than those of other business loans. Total project costs of $12 million plus are a possibility with 504 loans.

There are, however, certain weaknesses in 504s. For example, one of the most significant disadvantages of a 504 loan is a 10-year prepayment penalty. This loan's cash can't be utilized for working capital or a variety of other purposes. The SBA 7(a) loan can help in this situation. The Small Business Administration's most popular business loan can be used for everything from commercial real estate to inventory purchases to debt consolidation.

However, is it possible to combine the two? Taking out more than one SBA loan may be doable, but it will be difficult. Even if the SBA decides to accept it (and there is no rule against it), you must have a strong credit score, your firm must meet the size and industry standards for the loan, and you must have enough collateral to back both loans.

The SBA usually does not allow a single borrower to get more than one loan at a time. There are also some compelling reasons to take out only one loan at a time. You develop credit history and stability by taking out a loan and then repaying it. You demonstrate that your company is less hazardous than others, which encourages lenders to engage with you.

You can always talk to a lender or CDC about consolidating the two loans. Simply ensure that you have sufficient collateral, or that the SBA will allow you to utilize the same collateral to get two loans (this is rare, but not completely unheard of).

7(a) loan with a conventional loan (“pari passu”)

In certain circumstances, it is possible to have an SBA 7(a) loan with a companion “pari passu” conventional loan. This basically means both loans are senior, or 1st, position. The bank would fractionalize the note and both loans would have senior priority.

Why is this important? Often, the total project cost exceeds $5 million, which exceeds the SBA’s maximum loan amount. For example, you are buying a hotel for $8 million. You got an SBA 7(a) for $5 million and a conventional loan for $2.2 million.

Most lenders don’t offer pari passu financing, but there definitely options.

Conclusion

As you can see, the Small Business Administration enables lenders to offer powerful financing programs for business acquisitions. You can finance all or a portion of a business you want to buy or expand. Terms are generally among the best you can get with high leverage, long-term debt. With very little equity injection, you can be on your way to realizing your dreams.

However, these loan programs can be complex. The objective of this book is to take the fear out of the process. Guidelines are always changing and banks all have different appetites for loan scenarios.

This is why you should consult with an experienced commercial loan advisor. They can be of great value in helping you navigate these programs, often with no additional cost.

If you want to expedite your learning curve and make the most of the SBA financing options available to you…

Book a call with Beau here.